See how a renovation achieved a 13 per cent yield from our business partners at BMT Tax Depreciation. Australia’s renovations industry appears to be profiting from weaker economic conditions and tighter lending standards, with alterations and additions to residential buildings hitting a historic high recently. Australian Bureau of Statistics December Building Activity data showed a 6.6 per cent increase in alterations and additions in 2018, with renovation spending reaching $2.27 billion in the December quarter.

This indicates homeowners and investors seeking to improve capital values and increase rental income have been renovating their properties, rather than purchasing anew. It’s expected this boom will continue, as Master Builders Australia has forecast homeowners and investors will spend $8.8 billion annually on renovations over the next five years.

Renovations can significantly increase rental income. According to the first CoreLogic Quarterly Rental Review for 2019, gross rental yields are currently around 4 per cent. However, in some scenarios, renovators can achieve a 13 per cent return on their renovation investment.

Renovation case study to increase rental income

Let’s look at a case study where an investor completed a $60,000 renovation.

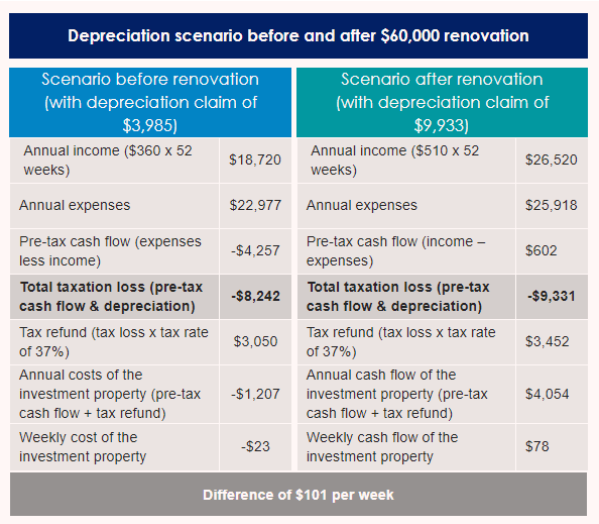

Here is the investor’s scenario before and after completing the renovation.

Original purchase price (before renovation) = $410,000

Rental income per annum prior to renovation = $18,720

Total renovation spend (completed in 2018) = $60,000

Property value on completion = $565,000

Rental income per annum after renovation = $26,520

In 2018 kitchen, bathroom and other cosmetic renovations were made. Newly installed plant and equipment assets included an oven, cook top, dishwasher, rangehood, carpet, blinds, lights and a split-system air conditioner. The investor also installed fixed and structural items such as kitchen cabinets, benchtops, a bath, toilet and tiles.

A post-renovation valuation found the property was now worth $565,000. A property manager’s rental appraisal also found the owner could earn $510 per week.

Below is the investor’s tax scenario before and after the renovation.

Prior to the renovation, the investor was experiencing an annual cash loss of $1,207.

However, after renovations their weekly rental income increased by $150, achieving 13 per cent yield on the renovation cost. They also turned their annual cash loss into a positive cash flow of $4,054, an additional $5,261.

Renovation tips and traps

While this example shows the great results possible, it’s important to be aware of some tips and traps before committing to a renovation project.

Scrapping can increase deductions when renovating

As part of any renovation, old assets will be discarded and new assets will be installed. When removing structures or assets from an investment property, existing assets may have a residual depreciable value. A process known as scrapping should be applied to ensure undeducted entitlements are claimed.

Asset selection when renovating affects depreciation deductions

Choosing which assets to install can also make a difference to what can be claimed once a renovation has been completed.

Items that serve similar purposes, such as flooring, depreciate at different rates. Carpet installation with a $2,000 cost will result in $500 in depreciation deductions in the first full year compared with floating floorboards and tiles of the same cost, which result in $267 and $50 in deductions respectively.

Avoid overcapitalising when renovating

Investors should stick to a budget when selecting items as it’s easy to overcapitalise. This is particularly relevant in today’s property market, where according to CoreLogic dwelling values fell by 7.4 per cent from their peak in October 2017 to the end of March 2019.

As many capital cities have experienced price declines, investors need to be wary of recouping the dollars spent during a renovation, particularly if they are planning the work to help sell their property at a higher value or raise the cost of rent to increase rental income. Sticking to a budget is crucial.

Seek advice prior to starting work, particularly if living in the property while renovating

A specialist Quantity Surveyor can provide advice on potential deductions available including whether depreciation legislation changes passed in November 2017 have any impact on your personal situation.

If you’re living in a residential property whilst completing a renovation, work completed can impact future deductions should you rent the property later. Newly installed plant and equipment will be considered previously used if items are added to a residential property while living there. BMT data shows one in four people lived in their property before renting it out in FY 2018/19.

There are exceptions. Substantially renovated properties and capital improvements to fixed and structural items aren’t affected. Even if fixed and structural improvements were completed by a previous owner, a new owner can still claim these items in the future.

Visit the BMT Tax Depreciation renovations add value page to learn more today.

Assumptions and disclaimer

This article originally appeared on the BMT Tax Depreciation website blog and is re-used with permission.